Childcare subsidies to increase from 10 July 2023

Families will be over the moon when from 10 July 2023 most families using a Kool Kidz childcare service will see their out-of-pocket childcare costs reduced and new families will be eligible for the first time to receive childcare subsidy.

Overview of the new childcare subsidy from July

- The maximum amount of Childcare subsidy percentage is increasing from 85% to 90%.

- Families earning $80,000 or less will get 90% subsidy.

- Families earning over $80,000 and under $530,000 will get a subsidy that tapers down from 90%, depending on their income. The subsidy will go down 1% for each $5,000 earned.

- Families with more than one child aged 5 or under in care can still get a higher rate for their second and younger children of up to 95%

- First Nations children will get at least 36 hours of subsidised care per fortnight to encourage indigenous families to enrol their children in an early learning service.

Free Kindergarten

In addition to the increased subsidy, the Victorian Government will offer an additional $2,000 per child for 3 and 4 year old Kindergarten at long daycare services like Kool Kidz, which will further reduce out of pocket expenses for families.

This is welcome news for families who want to consider enrolling their child at a Melbourne childcare service like Kool Kidz or who want to increase their child’s current enrolment. Providing children with early education is the first step to getting your child school ready and ensuring they have a bright future.

Calculate your new subsidy rates

To find out how the new subsidy rates will affect you, use the childcare rebate calculator here

Frequently Asked Questions:

1. What is Childcare Subsidy?

CCS is financial assistance provided for families who wish to enrol their child/children at an approved

Childcare and Kindergarten service from the Federal Government. The subsidy is given to your childcare service who will deduct it from your daily fees.

2. Who can get Childcare Subsidy?

To receive financial assistance, you or your partner must meet the following criteria

- Be the carer of the child at least 2 nights per fortnight

- Meet residency rules ie currently live in Australia and hold either Australian citizenship or (permanent

- visa, specific category visa, partner provisional visa or temporary protection visa)

- Will be responsible for paying the childcare fees

- Use an approved childcare centre service

- Your child meets immunisation requirements

- Have a Centrelink customer reference number (CRN) and each child must have one too

3. How much financial assistance will I receive?

The CCS is calculated as a percentage based on your combined income and activity test.

4. Will I receive additional assistance if I enroll more than one child?

Yes! If you have two children aged 5 or under attending long day care and/or out of school hours care you will be eligible for a second discount through your childcare subsidy. This will apply to your youngest child, the discount will depend on your current CCS entitlement but in most circumstances it will be 30% extra, up to 95% of the total fee for your second child.

5. Is there any further financial assistance?

Additional assistance can be paid on top if you are

- A grandparent who is the primary carer of the child

- Transitioning to work

- Experiencing financial hardship

- For the child’s well being

6. What is the income limit in 2023?

From 10 July 2023, families with a combined income of up to $530,000 will be eligible to apply for childcare subsidy. The increase means families who were not eligible before will now have the opportunity to receive the subsidy.

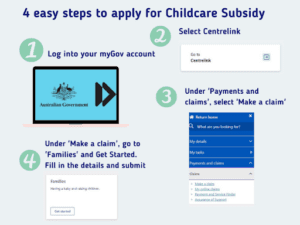

7. How do I apply for childcare subsidy?

- Log into your myGov account

- Select Centrelink

- Under ‘Payments and Claims’, select ‘Make a Claim’

- Under ‘Make a claim’, go to ‘Families’ and ‘Get Started’. Fill in the details and submit

For more information, visit Services Australia

What do I need to do to obtain the new subsidy rates?

To ensure you are obtaining the right childcare subsidy, make sure your income estimate is correct for the next financial year. The changes will be applied automatically.

For families new to childcare subsidy, make a claim through Centrelink myGov account.